Purchase an investment property with Mynd

Build a single-family rental portfolio that outperforms

Curated investment properties

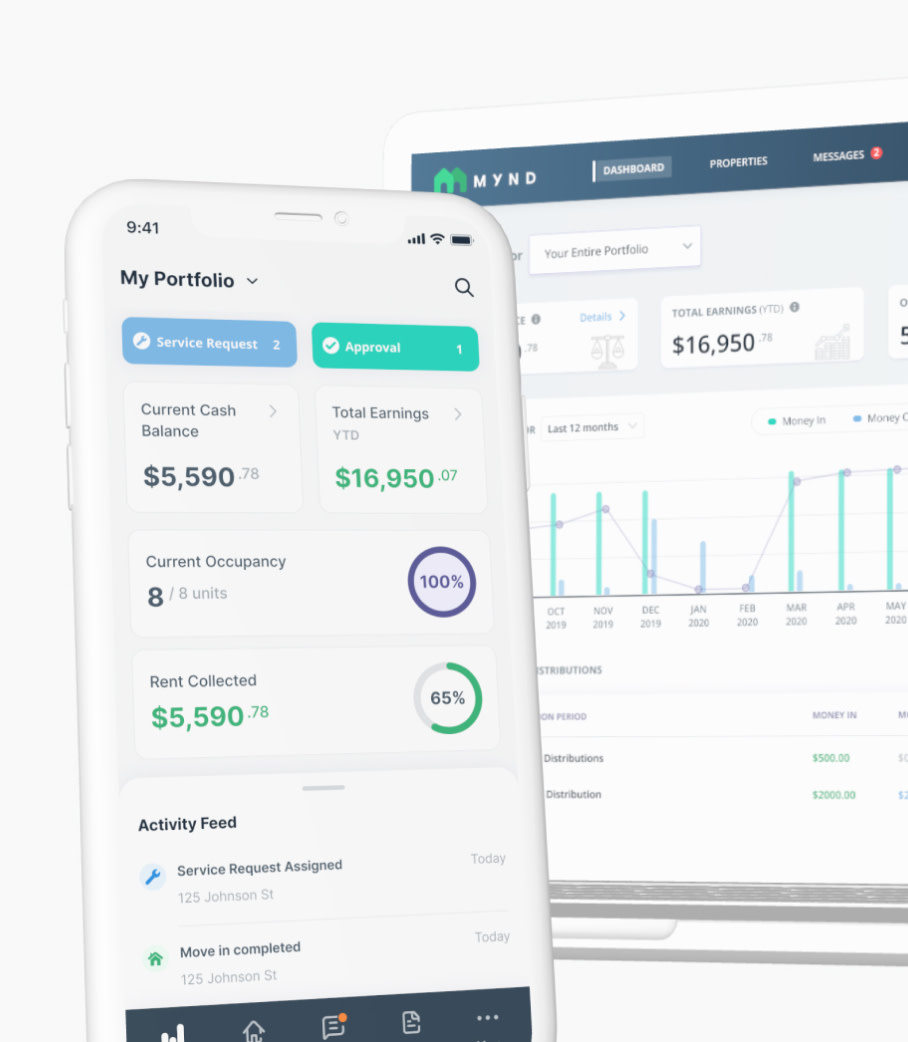

We help investors buy, lease, manage, and sell properties all-in-one place. Invest in top markets throughout the U.S. and build a geographically diverse portfolio… all from the comfort of home.

25+ markets

$600m+ in acquired properties

5000+ investors

15,000+ properties under management

Integrated property management across 25+ markets

Low monthly rates for investors looking for one property manager across their entire real estate portfolio. Pricing based on location.

Select your location

How it works

Sign-up for deals

Provide your contact info to get a list of our current off-market exclusives. These properties are curated for investors and can ONLY be found via Mynd.

Purchase and close

We try to make it as easy as possible for investors: we help you find the right property that matches your long-term investment goals and handle everything else along the way.

Next steps

Once you close, we’ll help with next steps. With our full-service property managers across 25+ markets, we’re ready to help you lease, renovate, and maintain your investment property.

SFR: your new favorite asset class

Why single-family rentals?

Passive incomeLong-term appreciation

Equity leverage

Tax benefits

Unlock single-family rentals as an investment asset class with historically safe, stable, and profitable returns.

“What I really like about Mynd is that I get to be an investor, like a true investor, as opposed to being a landlord.”

Shanif Dhanani

SFR Owner/Investor

Investor location: NYC

Investment location: Atlanta

From our Resource Center

Ready to speak with our team?